Navigating ESG financial products is challenging. Putting aside the fact that there is a conflation between ESG, SRI, and Impact funds and indices, there’s a more significant challenge out there. Quarterly and annual reports looking and ESG inflows and returns miss the bigger picture. ESG products (if they are actually ESG products) pick stocks of companies that manage their ESG risks and opportunities well and hopefully build resilience over long-term horizons. They may or may not consider short-term alpha or transient issues and may consider a mix of other factors, depending on how heavily the ESG part is integrated into the product.

And so, we have two tales of ESG financial products, one where perhaps market cap is heavily weighed and one where they may appear lucky but might be at risk. Both leave a lot of questions on the table, which is pretty typical for ESG. First, let’s examine the S&P 500 ESG Index and Tesla, then consider Nvidia’s stellar growth and the Swedbank Robur Technology C, which has the most exposure to Nvidia.

Tesla is out and in the S&P 500 ESG Index

In May of 2022, S&P Global rebalanced S&P 500 ESG Index with the high-profile stock, Tesla, being removed. At the time, anti-ESG pundits wondered how an Electric Vehicle (EV) company could be removed from an ESG index. After all, surely their Environmental focus would deliver a sustainability impact. However, ESG isn’t the same as sustainability (not to mention lithium mining has many Environmental problems).

In a blog article from the time, S&P addressed the concerns that led to the removal.

A few of the factors contributing to its 2021 S&P DJI ESG Score were a decline in criteria level scores related to Tesla’s (lack of) low carbon strategy and codes of business conduct. In addition, a Media and Stakeholder Analysis, a process that seeks to identify a company’s current and potential future exposure to risks stemming from its involvement in a controversial incident, identified two separate events centered around claims of racial discrimination and poor working conditions at Tesla’s Fremont factory, as well as its handling of the NHTSA investigation after multiple deaths and injuries were linked to its autopilot vehicles.

These all seem like really material ESG issues. An EV company that lacks a carbon strategy would likely see reputational questions from activists for greenwashing. Claims of racial discrimination and poor working conditions would likely impact talent, attrition, and productivity and possibly garner the attention of EHS regulators. Not working with a regulator that can force recalls on your cars can cost money, software development, and perhaps even service tech time. All of these issues are summarized in the bolded phrase above and point to the core reason why Tesla was removed from the index - risk.

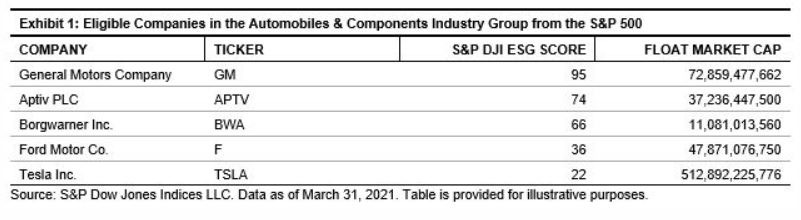

A year earlier, S&P placed Tesla in the index. They posted a different blog article to explain why Tesla, with a low ESG score relative to its peers at a 22, would be included. Reasons included the improvement in ESG scores from 2020 to 2021, still much lower than others, and the floating market cap size of the company, which is much larger than others. At the time, Tesla had the lowest ESG scores out of GM, Aptiv, BorgWarner, and Ford and a floating market cap size of $512B, well outpacing the others combined. In the end, this seemed to be a weighing factor. And so, for one year, Tesla was in the S&P 500 ESG Index.

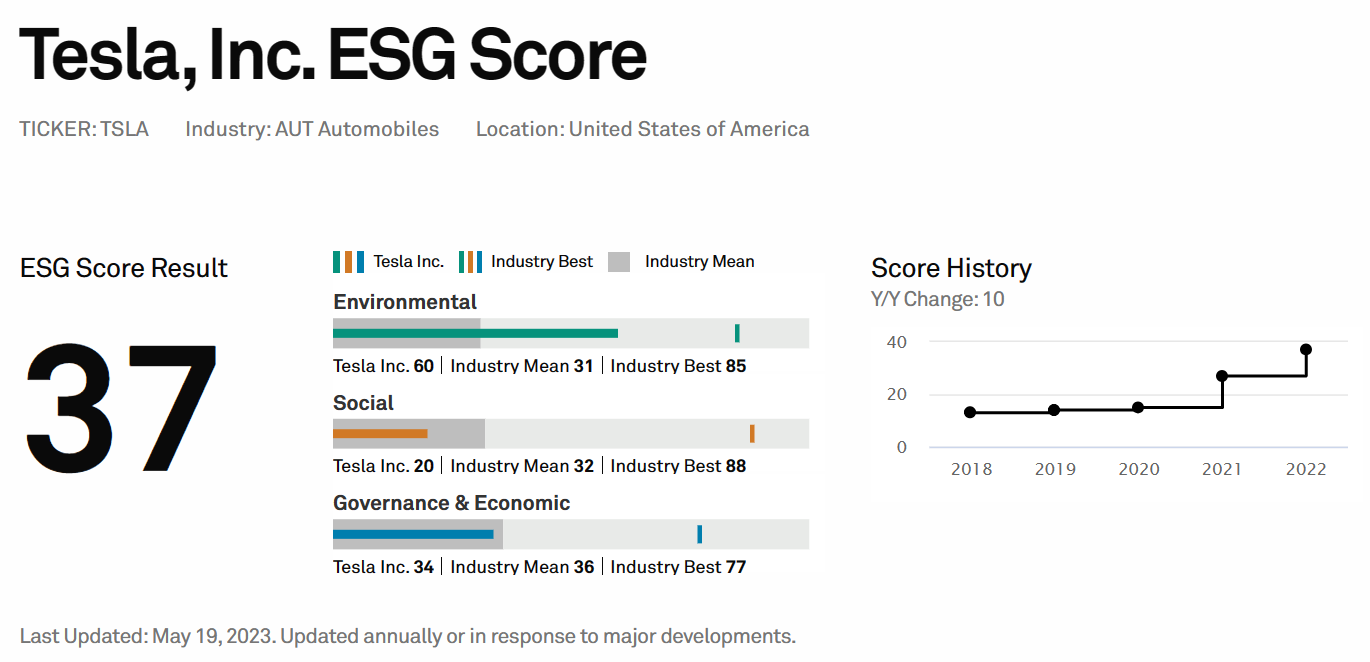

Strangely though, Tesla was added back into the S&P Global ESG Index in May 2023 with little fanfare or blog article. In fact, I completely missed it! Its ESG scores have jumped but are still not exceptionally high, and it has now participated in S&P Global’s Corporate Sustainability Assessment (CSA) survey. This survey collects additional data on Tesla on its performance outside of its CSR report. We can see the history of its S&P Global score back to 2018.

NOTE: The public S&P Global ESG scores are not the same as the S&P DJI ESG scores listed above but are not the same (methodology here).

I can only assume the jumps in ESG scores apply similarly since tools like the CSA are used in both.

Combine this with a still high market cap, and I think we have our answer as to why it was added back in. Yet, the company’s risks appear to be ongoing. The company now aligns with TCFD, has a SASB statement, calculates its carbon emissions (including 100% of lithium mining), and has a third-party audit of the emissions. As of 2022, it hasn’t reported into CDP or set SBTi targets but does report some high-level carbon strategy, including a Sustainability Council of executives. Still, the Fremont discrimination issue has been ongoing as recently as last week. Also, Tesla is off the hook with the NHTSA for its passenger gaming feature but not for its autopilot crashes. In other words, many of the risks that caused its removal are still out there.

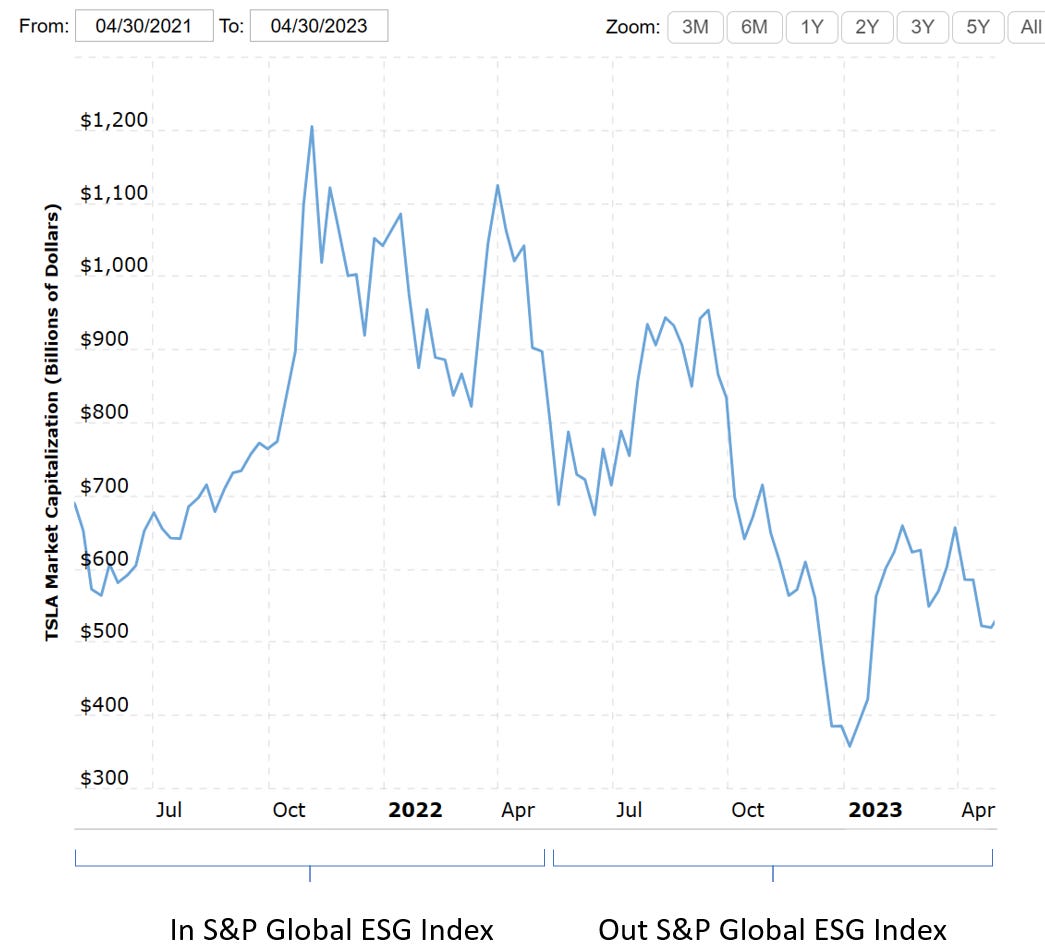

During the removal of Tesla from the index, the market cap shot up and came back down again. Again, ESG isn’t focused on these types of movements but on long-term growth and resilience. If Tesla is an ESG stock with quality risk management, I’d expect some normalization over the next few years, but we’ll have to wait and see. If nothing else, Tesla gives us a gauge of S&P’s methodology around the ESG Index. As we’ve seen recently with Silicon Valley Bank, Governance can disrupt everything, casting doubt on any ESG effort.

With Tesla back in and its huge market cap, it is again one of the top 10 constituents of the S&P Global ESG Index. As funds are created around this index, understanding its methodology in the context of the return of Tesla is worth a close look for any fund manager.

Nvidia hits the $1T club quickly

Over the past year, AI seems to be a rising tide lifting many fund boats. Besides big tech roaring back, Nvidia has shot up 152% over the past 12 months. As the provider of the chips that will run new Generative AI workloads, this is no surprise. Still, with anti-ESG pushback casting doubt on companies like Silicon Valley Bank for its ESG stance, little is written about how consistent Nvidia has been with ESG over the past few years.

Let’s start with Nvidia’s S&P Global ESG Score, consistent since 2018. MSCI has also consistently given Nvidia an AAA since 2020, and the company appears on Glassdoor’s Best Places to Work list, which aligns with employee stakeholder engagement. Glassdoor has linked its list to stock outperformance.

Coming off of Tesla, 72 is a high score. With a market cap near double, it’s no wonder that Nvidia is also on the S&P Global ESG 500 Index and, unsurprisingly, in the top 10 constituents.

Here is its market cap during the same period from early 2018 through now.

Of note is the drop that started in early 2022. This was due to factors outside the company’s control, like slow PC sales, supply chain constraints, and inflationary pressures. Yet, ChatGPT’s release by OpenAI on November 30, 2022, and Nvidia’s importance in the hardware AI needs to run on, has lifted the stock price and market cap.

Let’s remember that ESG is not about short-term growth but long-term resilience. Nvidia has now put ESG fund managers in a pickle. The stock has accelerated short-term growth outside of ESG factors AND is a leading ESG company. Can this explosive level of growth be sustained? Eh, I’m not so sure, which means some ESG financial products may see trouble ahead.

For example, the Swedbank Robur Technology C fund has the largest exposure to Nvidia out of any ESG fund. According to the Financial Times, the fund has soared 34% this year, mainly due to Nvidia’s outperformance, with the following two funds with the highest exposure also showing significant gains this year. Since this is a technology-based fund, it also has mostly technology companies.

The Technology C fund is classified as an SFDR Article 8 fund, considering environmental, social, or sustainability characteristics and good governance practices. It is not pursuing a specific sustainability objective, in other words. This type of fund integrates ESG and considers more material risks and opportunities.

In its 2022 report on the fund, Swedbank Robur wrote, “At the company level, the largest negative contribution came from Nvidia.” Yet, it still kept it in the fund and its exposure still put it at its second-highest holding, which makes sense when you consider this statement:

We have a long-term investment horizon and choose the companies we consider to be attractively valued in relation to our view of the company's future earnings potential.

Swedbank Robur has a lot to think about now. Through Nvidia’s anomalous growth, does it take some gains and rebalance the portfolio or ride it out? Will other ESG funds that have overlooked Nvidia add it at these new highs? I don’t expect much to change since ESG is less about these short-term moves, nor is it often the sole factor in making an investment decision. Still, it’s fun to ponder.

It still makes me wonder whether Nvidia’s growth is sustainable despite its consistent ESG performance. In its latest CSR report (linked below), Nvidia does something interesting. It orders the report by Governance, Social, then Environmental. If they put Governance first, that long-term resilience should come through, but, like Tesla, we can only wait and see.