If you don’t know, my job is to meet with companies and talk to them about their environmental sustainability efforts and see where technology can play a role. I came into this role supporting Capital Markets and seeing the disconnect between investors and corporates. As a result, the little ESG elf in my head pokes his head out when I’m talking to companies and asks them how they address this or that material risk.

Often, the answer is surprising. They aren’t addressing ESG risks at all. Many don’t believe investors care about ESG, only carbon measurement. This leaves Gary, said elf, wildly disappointed.

And so, many companies are laser-focused on environmental sustainability at the moment. Feelings and emotions were high coming out of COP26, but a year later, companies were discouraged from learning that this focus isn’t enough and more is needed. This should be of no surprise, however. While climate change has long been a concern, the corporate focus has started just in the past few years, with the social pressures around COVID highlighting all aspects of ESG. The focus at COP26 on the urgent climate issue and constant extreme weather has refocused everyone. What started as solid attention to ESG has quickly fizzled into an exercise in CSR. Let’s remember:

CSR represents E, S, and G tables stakes issues broadly universal and have become a license to operate.

ESG represents E, S, and G issues that are material risks and opportunities. There will be a mix of some universal issues and specific challenges by industry and company.

The former is in the driver’s seat, while the latter has been left on the side of the road. Of course, companies need to be doing all of it, which is why that elf keeps poking his head out. Why aren’t they?

First, we are facing a global crisis driven by climate change, with the threat of extreme weather growing annually. The evidence is irrefutable, and we need to accelerate change. Second, operational reductions around carbon can be simpler than dealing with the complexity of ESG. Here’s how:

Companies can buy carbon offsets.

Companies can buy renewable Power Purchase Agreements, contracts to purchase power and renewable energy credits (RECs) from an energy provider.

Often, a company’s emissions will sit in with their suppliers via Scope 3 since 90% of their value is in intangibles and not in owned assets or operations (except in specific heavy-emitting industries like energy, manufacturing, etc.). In other words, the problem can be pushed out.

These three things make it easier to set goals because companies can take easy actions or pressure others without making substantial operational changes and reductions. On the other hand, addressing an ESG risk or creating a new opportunity would be even more difficult. I do come across some companies willing to get their hands in the supply chain, but it is typically not the norm.

Compounding this is a lack of sustainability talent. While some companies have long-standing teams for sustainability efforts, more often than not, I see a pair of new types of teams dealing with sustainability:

Passionate people hired internally who understand the company well but have little practical sustainability/ESG knowledge and training, often led by the marketing organization.

People with practical sustainability/ESG knowledge but missing the material understanding of the business.

This is visualized differently below but is close to what I observe.

Full disclosure: Microsoft commissioned the linked report above, and I work there.

The mix of climate change pressure, simpler ways to address climate change, and the talent gap mean that many are not focused on their ESG risks or opportunities. In effect, they are augmenting, accelerating, and even attesting now to one effort companies have been doing for a while - CSR.

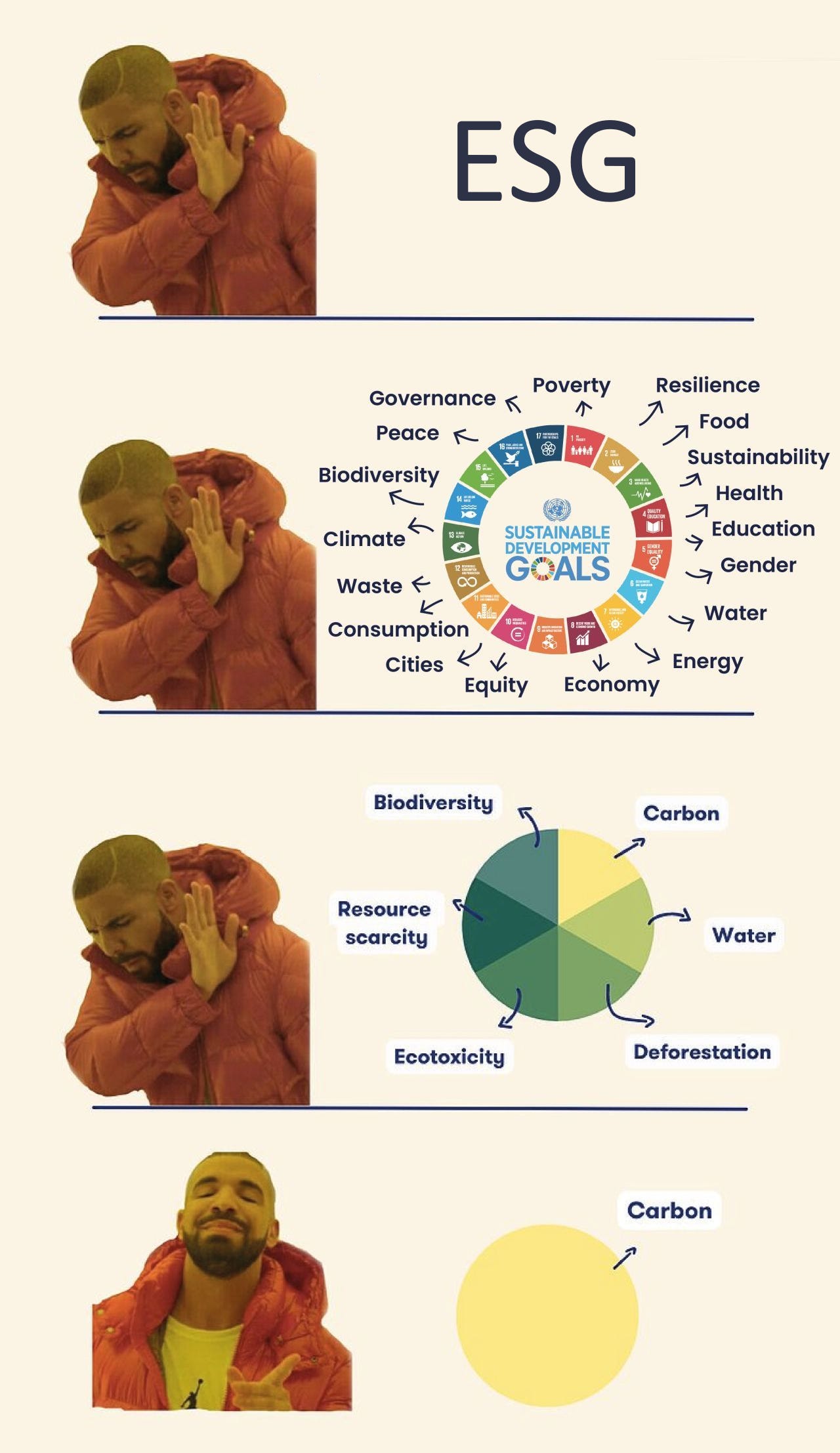

If you prefer memes, here’s another view of what I’m seeing:

There is another pair that can help us think about why sustainability is so prioritized over ESG. A few weeks ago, I wrote about two broad ways countries, companies, and investors were looking at climate change. Money appears to be flowing in a very specific way.

Mitigation: Operational reductions manifesting in that intense focus on carbon. The leading approach is through commitments with planning underway at varying maturity levels. Companies favor this approach as this is an investment in sustainability improvements to about $5.7T annually.

Adaptation: Thinking about the risks of climate change and creating plans to adapt. This happens at a local level with positive results for communities and often with clear and immediate benefits. As a result, countries favor adaptation. This is primarily viewed as a cost (akin to an insurance policy) but is an investment in protecting from ESG risk. The adaptation costs could reach $300B but are currently woefully underfunded.

And so, with this pair, we can see another reason why companies are so focused on carbon. It represents mitigation, which is where a lot of money is flowing. But, still, countries are onto something. The local attention garnered through adaptation keeps a company in business because it is material but unfortunately overlooked.

So, what do investors want?

With all that out, let’s finally get to investors. Are companies aligned with what investors want? Well, maybe depending on the investor, which brings us to our final pair. Companies that focus on carbon (and hopefully) other E, S, and G table stakes issues through mitigation efforts garner these types of investors:

Socially Responsible Investors: Investors interested in saving the world from climate change (or other themes, like a diverse board, gender equality, etc.).

The SEC’s draft proposal calls this “ESG Impact.”

But, investors understand risk very well. Remember, ESG is about risks (and opportunities). So, we have investors interested in companies who adapt to their E, S, and G issues well.

ESG Investors: Investors who understand ESG risks and opportunities and can place value on a company’s understanding of this topic and how well they address it.

The SEC’s draft proposal has two labels for this. “ESG Integration” means that ESG factors are integrating into the models. “ESG Focused” means that ESG factors are a main consideration.

Company leaders need to focus on all of it to garner investor attention, but addressing risk is Business Operations 101. If you aren’t paying attention to your risks, investors will be put off, and you will lose their confidence (note: this is a G issue).

How do I know this? I’ve been talking with Financial Services firms and data aggregators for the past few years. Investors can quickly uncover your carbon emissions and efforts by scraping CSR reports and using industry estimates to validate. It’s the mountain of all the other published (and not published) ESG information they are struggling to evaluate. This is where risks lie.

Some recommendations for any sustainability team or business leader to capture it all would be:

Sustainability leaders work closely with Operations and Procurement to lower emissions internally and across your eco-system and move into other mitigating other environmental aspects (water, waste, and biodiversity). Consider the local impact on communities where you operate as well.

Complete an ESG materiality assessment and build a stakeholder mapping to understand your most material issues, not just those that address climate change. For both public and private companies, review your industry’s SASB Standards. Then, bring business units to discuss the findings openly and empower them to act.

If you are a publicly traded company, work with your investor relations team to talk to the data rating agencies to find out what they believe are the most material issues for your industry/company.

Educate employees on sustainability and ESG risks and empower them to address both at the edge, as they would any challenge relevant to their business area. Done right, this can build a cohesive culture and uncover areas of improvement across both sustainability and ESG.

NOTE: don’t forget the value of diverse thought here!Data underpins all of this, meaning digitization efforts must be undertaken because the core business systems are where ESG signals will be found. Still, many systems are legacy and were not built to create these signals. So if you’ve been holding off on Digital Transformation, now is the time.

Here’s the TLDR example: If you drive towards saving the planet with operational carbon reductions, but your assets and suppliers are underwater because you forgot climate risk, investors and other stakeholders will be pretty upset.

Saving the planet is great and we have to do it, but you want to be sure your company is there to enjoy it.