This past week, I spoke at an event at MSCI called “Reality Checking Sustainable Finance.” I was fortunate enough to be on the DEI panel. I dipped into various stakeholders and focused on the success through material approaches, not just the company’s EEO-1 metrics and representation within the company.

There were many takeaways from the event, which you can find on the MSCI Institute’s website. I encourage you to take a look.

Before the event was over, something about its flow and the discussion got me thinking about each pillar of ESG separately.

The agenda ran according to the order of the acronym:

What’s Up with Sustainability and Performance? (Environmental)

From Boardroom to Bottom Line: What Do We Know about Diversity and Value Creation? (Social)

Sustainable Finance in the Mirror (Governance)

In ESG Mindset, I write about the interconnected nature of risk and how, if we stop using the acronym “ESG,” we might just lose that perspective. This is critical for dealing with new crises that impact our companies. Still, I may have overlooked the differences in each pillar. At this unique period in the evolution of ESG, sustainability, DEI, board governance, and proxy voting, each pillar has unique attributes and is in a siloed evolution.

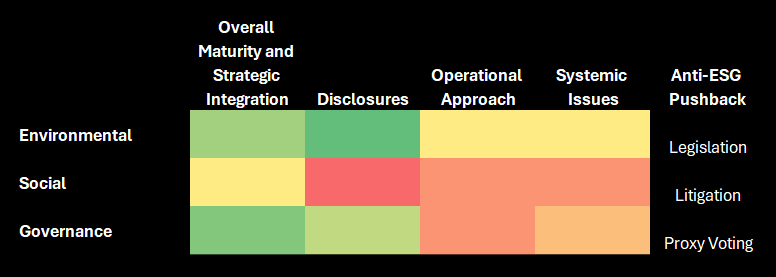

So, today’s newsletter will be a bit different as we reality-check each pillar of Environmental, Social, and Governance across several factors.

We’ll start with a brief overview.

Maturity and Strategic Integration - The maturity of the pillar along its ideal state and if companies have built long-term strategies around it.

Disclosures - The state of disclosures around the topic.

Operational - A look at whether companies have integrated the pillar into operational matters.

Systemic issues - Examining companies, partnerships, and consortiums and their progress in solving more systemic issues around the pillar.

The Anti-ESG Push - The pillar’s relationship to the Anti-ESG movement and each unique push-pull tension.

Like any ESG analysis, I made a little scoring matrix to match the ‘gut feel’ and anecdotal evidence I’ve collected here.

Let’s jump in, but first, don’t forget to subscribe if you haven’t!

Environmental

The Environmental pillar covers Environmental risks and opportunities that affect the company. For example, material intersections exist in manufactured products, the energy transition, climate risk, etc. Often, companies whittle the Environmental pillar to one focus—carbon.

Externalities resulting from extractive global operations and their impact on the company could have various effects, such as fines, litigation, and more.

Maturity and Strategic Integration

While investors have long focused on Governance, the Environmental pillar is perhaps now the most mature regarding a company’s attention to the topic. A renewed investor focus on Environmental concerns in the late 2010s led to new financial products and new board and management team attention. New roles, like Chief Sustainability Officer, value chain analyses, and carbon accounting standards, lead the charge.

Governments and public-private partnerships, like those that emerge from the annual COP meetings, in concert with growing science and undeniable extreme weather events, have quickly compounded into a deep understanding of the topic if companies are willing to look and listen. Yet, climate risk and planetary systems are too often overlooked.

The focus may be intensely on the Environment, but it is often on disclosures, not operational shifts or the strategic considerations surrounding it.

Disclosures

The Environmental pillar is, by far, the most mature from a disclosure perspective. The past few years have seen key regulations and frameworks like the EU’s CSRD, the SEC’s climate rule (currently paused), and the ISSB S1 and S2, which jurisdictions globally are adopting.

It is essential to recognize that these particular regulations and disclosures are to provide comparable data for investors and stakeholders. While the EU cuts across the Environmental, Social, and Governance, the other regulations lead with the Environment.

There is no doubt that regulation and disclosures lead this pillar, even with some states/jurisdictions suing (Michigan, Hawaii) and legislating against (Vermont) fossil fuel companies. This is critical for energy companies, as carbon represents a material risk along the transition. However, Environmental issues are not universally material across every metric for each company, and disclosures appear to be hindering progress. There is a lot of agita from sustainability professionals around data collection and reporting instead of focusing on meaningful actions.

Another unfortunate aspect is that early indications from investment firms suggest that, even though disclosures attempt to create comparable data reporting, the materiality, business complexity, and individual company differences make the data too incomparable despite being standardized.

Operational

From an operational perspective, companies must focus on what it means to operate their business in a low-carbon economy while also responsibly managing its relationship with the Environment. These are the operational basics for the Environmental pillar.

Yet, the world’s companies are focused on disclosures. As a result, the operational integration has stalled in many places. Sustainability professionals have turned into carbon accountants rather than operational leaders. People reach out to me every week to find out how they can better drive impact and action at their companies because they either see the risks and opportunities or want to drive progress but are stuck with measuring and disclosing.

Some companies are integrating Environmental considerations into operational functions. For example, many agriculture and food/beverage companies understand and work around the delicate balance and risks that exist around the Environment as it changes. Also, the largest companies in the world typically understand their material intersections with the Environment, as do B-Corps.

Still, many are only disclosing and delivering the table stakes of change, which I often equate to ‘changing the office light bulbs to LEDs.’

Operational integration can be found, but it has largely not been mainstreamed.

Systemic

The Environmental pillar also includes systemic issues that are too big for a company to solve, such as climate risk and biodiversity loss. These issues can impact the company's physical locations and value chain, but the focus is more on operational reductions than adaptation to the systemic issues.

From an Environmental perspective, companies pay the most attention to disclosures, followed by operational improvements (in various stages of maturity), and last, attention to these systemic issues. It is similar to the financial perspective, focusing on short-term results first, followed by the long-term (this is hyperbolic but often true).

So, short-term mitigation efforts lead the charge through Environmental disclosures, and adaptation efforts are largely overlooked. Even the suggestion of “Loss and Damage” funds to help Global South countries plan for, adapt, and recover from extreme weather damage remains underfunded. Still, at least the UN is meeting about it.

Systemic issues can’t be solved in a bubble. Companies must work across their industry and value chain to meaningfully decarbonize or manage their most material Environmental intersections, not just at their local operational level. Unfortunately, the systemic issues may be stalled due to the staggering costs involved ($9.2T annually) and the emergence of green-hushing and anti-trust concerns, which can prevent companies from working together.

Anti-ESG Pushback

Most pushback against ESG in the West comes from the Environmental perspective. Activists focused on the systemic transition don’t see it as multi-faceted or that we could harm people by ‘turning off the gas.’ Politicians, eager to capitalize on any boogeyman they can find, have latched on to the energy transition and interpret it as a boycott from the financial markets.

The latter seems more problematic to companies as states are legislating against ESG.

Yet, it is important to remember that this pushback against the Environmental transition is a pushback against the core commodities in conservative states, like fossil fuels and coal, even as they lead the US in renewables. Meanwhile, the political points cost citizens hundreds of millions in interest.

The Anti-ESG pushback under the Environment is the most robust out of any pillar and the one stopping most progress, even outside a single pillar. Still, new litigation is emerging against polluting companies and increasing extreme weather, and the anti-ESG pushback in politics will face challenges as the reality of the situation settles in.

Social

The Social pillar covers risks and opportunities related to stakeholders. People are in the middle of the acronym. For example, a company must understand its relationships with employees, customers, suppliers, governments, etc. In some cases, shifts in what it means to operate in a civil society will need to be monitored.

Like the Environmental pillar, the Social can be extractive, taking value from labor and passing it over to companies.

Maturity and Strategic Integration

The Social appears to be the least integrated at companies, at least well. Since 2020, there have been two key tipping points in tension. First, COVID and hybrid work have changed the landscape of employee purpose and the nature of cities. Second, George Floyd’s murder resulted in transient DEI programs that are winding down.

Overall, companies have failed to realize how diversity can represent new talent pools to tap or how equity can help keep employees at companies through promotion and pay equity opportunities. Inclusion can also assist with employee retention by creating a safe place for employees to work. These include the shift in power to employees and the rise in collective bargaining and unionization over the past few years.

…and these are only examples of employees as stakeholders. Customers as stakeholders have had missteps as social norms shift and as companies misunderstand their stakeholders or the power of the culture wars. Capitalizing on social change has never been more fraught with trouble.

Strategic integration may be attempted, but it often doesn’t start from the company’s perspective. Only here can a company build defensibility to cover more systemic concerns.

Disclosures

Disclosures around the Social pillar are complicated. How can you measure people, after all? Well, there are some ways companies try.

While there are DEI representation metrics that describe the racial and gender makeup of the company (like EEO-1 in the US), these are of little use when compared with the value that can be found in the company’s culture. This intangible is very difficult to measure but can be found in stats around productivity, burnout, collaboration, and employee surveys about sentiment.

There are other metrics to inform the Social pillar, like analyzing customer sentiment or brand value. These are not typically regulated disclosures or even aligned with frameworks and standards.

Today, the Social pillar remains a qualitative pursuit that can be understood best through storytelling rather than metrics. Generative AI and LLMs may help with this analysis, but it is early on.

Operational

Operationalizing the Social means understanding your stakeholders well and leading with programs and efforts focusing on the material risks and opportunities that stakeholders represent.

This is a very tall order and involves everything from supporting people in their careers and empowering them to act to build a company that understands its stakeholders.

Unfortunately, ‘Best Places to Work’ lists and customer satisfaction scores might be our only window today into which companies are operationalizing the Social well. Measuring a lack of diversity or ‘groupthink’ may be shown through representation metrics, but not necessarily.

As with the Environmental pillar, specific industries intersect more materially with stakeholders and the Social than others, like healthcare, education, life sciences, fashion, and tobacco.

Systemic

The Social pillar has a high level of systemic issues globally. DEI and forced labor are the most obvious ones to address. While companies may or may not have concerted efforts to hire diverse candidates or look to capture new markets, it is unlikely that a single company alone can solve systemic issues similar to the Environmental pillar.

A company can and should do its part, but that is just a part of the whole.

Companies that are looking to address DEI issues systemically must approach them from within their business and not outside of it; otherwise, they risk a transient effort. For real impact on DEI and forced labor, coordination across public-private partnerships, governments, and industries is needed.

Anti-ESG Pushback

No one appears to be pushing back that a company shouldn’t consider its stakeholders. There is less anti-ESG pushback along the Social pillar and more specific pushback on DEI efforts focused on solving systemic issues, at least in the US. This is led through litigation claiming reverse discrimination.

The litigation here leads the charge. We’ve seen the US Supreme Court roll back affirmative action and Roe v. Wade. Both have stakeholder implications at a material intersection with the company. If a company can’t leverage DEI to find diverse candidates, it risks groupthink. Also, healthcare restrictions for women affect employees and their well-being.

In the past few weeks, we’ve seen two similar DEI cases with different results, so it is hard to gauge where things are. Hello Alice and Progressive were sued for a program to support vehicle grants to Black business owners, with the case being dismissed. Meanwhile, the Fearless Fund, offering grants to Black Women, lost its case.

Governance

The Governance pillar covers boards and the management team. For example, a company’s board members should have material experience, consider ESG, financials, operations, and systemic issues, and be able to arrive at a consensus amidst new uncertainties.

With increased interconnected issues due to globalization, the rise of intangibles, the shifting power of stakeholders, and the pressures to transition, running a business is no longer an inactive, self-sufficient exercise. It takes active board engagement and proactive planning to be successful. Increasingly, it relies on active investor engagement, not just divestment, but it has yet to tip over.

Maturity and Strategic Integration

The Governance pillar is the most and least mature, depending on the perspective. Governance has long been a focus of investors, and obviously, a poorly run company wouldn’t last very long. Still, what is new is the usage of proxy voting mechanisms to move the board. Even today, this lever is rarely used due to investor complacency.

This proxy season has been like no other. While we did see Engine No. 9 famously displace incumbents on Exxon Mobil’s board in 2021, 2024 has seen CalSTRS recommend a complete board refresh (failed) and Exxon Mobil suing Arjuna Capital for continuing to ask for sustainability relate- resolutions (in progress). We’ve seen proxy resolutions to replace the CEO at Boeing after multiple controversies (failed). Soon, we’ll see whether or not Elon Musk’s brother will remain on the board of Tesla or if shareholders will approve his $54B pay package.

Proxy resolutions have led Governance influence lately, but investors refuse to pull the lever.

While Governance is at the crux of strategy, it may tend to be more performative than structured and well-integrated. For example, if you check a company’s Governance or board management policies, you will likely find boilerplate language. Whether or not the company adheres to these policies and how well they are integrated may be more of a qualitative exercise to pursue, similar to the Social pillar.

Due to the complexity of Governance, it can work against the company if it attempts to be insular or preserve the status quo in a rapidly changing world. Unfortunately, the maturity and strategic integration of Governance is only obvious in the hindsight of a crisis or a complete company failure.

Disclosures

Governance disclosures can often be found within financial filings, like 10-Ks and SOX-related disclosures, and in information about the boards, as available. This information is not usually standardized, making the analysis difficult. The review of the performance may be subjective, especially if published by the board or the company itself.

Information about the board can be found from publicly available sources, including social media, financial filings, and company news. However, this data is not often standardized and has some qualitative properties such as relationships, education levels, areas of expertise, decision-making and leadership styles, and more.

Operational

Governance should be completely operational at any long-standing company. As boards oversee the management team and the management team oversees the company, there is a chain of command with policies, procedures, and preferences for risk tolerance. Over time, history becomes precedence for good or bad.

While companies might have quality Governance policies and procedures with a clear structure to match, there is often inertia in driving change or embracing new methodologies to address risk.

Operationalizing ESG-related Governance may mean creating a new team to work on emerging issues and mainstreaming ESG throughout the company.

Systemic

Can something as focused on one company’s performance have systemic issues? Absolutely!

First, many board members sit on multiple boards, which means the network and relationships can influence and compound problems and solutions across the markets, depending on the situation. Second, the same systemic issues around diversity also permeate board membership. Groupthink at the board level, or too much influence from one person, can impact quality decision-making.

Still, perhaps the one systemic thing that has permeated boards (and the markets) for decades has been pursuing short-term results at the risk of long-term resilience and growth.

Anti-ESG Pushback

The anti-ESG crowd, at least indirectly, pushes back on boards and management teams. The weapons of the culture wars, like boycotts, can indirectly pressure directors. We saw this with Target during Pride Month and Bud Light. This is mostly where the other pillars intersect with Governance.

While proxy resolutions are rising as the lever to enact change, anti-ESG proxy advising (or ISS’s ‘proxy skeptic’) and similar proxy resolutions are growing (up 60%), although still receiving little support as of today (and ESG resolutions aren’t doing much better).

The Anti-ESG pushback on boards is nascent but works through stakeholder pushes and investment ownership.

Overall

While companies are expected to deal with all pillars of ESG at once, considering their unique evolutions and journeys, companies would do well to start with the most relevant pillar before diving across the broader acronym or considering the interconnected nature of these risks and opportunities. This is the reality check needed for companies breaking out of the disclosures.

A short-term analysis that starts with material issues, a stakeholder review, and the board and management team’s understanding of each is a good starting point. To build a more robust approach, I recommend checking Chapter 7 of my book, which covers how to mainstream ESG.