The ESG Advocate 008 - Sustainability, ESG, and Degrowth

This week's newsletter is framed around a question asked by Theodora Lau, Founder of Unconventional Ventures and co-author of Beyond Good.

What if we embrace slowness and reset?

She ponders if, at an individual level, we can avoid burnout and live prosperous lives just by slowing down. After all, many of us drive ourselves towards burnout at work and sacrifice family time, all while we're killing the planet in the pursuit of growth.

When you lay it out like that, it's no wonder she had me thinking about sustainability and ESG across the individual, company, and global levels. She asks:

Can we afford to focus on what really matters?

'What really matters' means something different to everyone. Still, we've broadly created systems that drive never-ending growth at the planet's expense.

Let's get to it!

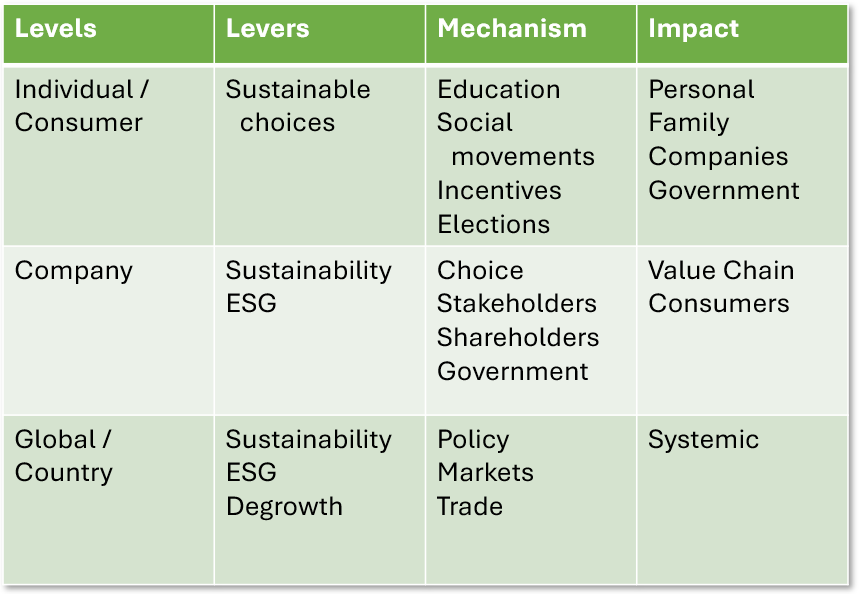

🪜Three levels of impact

Driving what matters happens in different ways across different levels. From each of us as individuals to the companies we work for and buy from to the governments of the world, there are different levers and mechanisms to achieve various forms of impact.

🌲Individuals and sustainability

Individual consumers will play a big role in driving sustainability, and every little bit helps. Individual action, in aggregate, can play a part in mitigating climate change and reducing risks for everyone.

This past week, we saw examples of two ways individuals come to sustainability.

🤔Choice (and not choice)

Europe is burning (literally in some places). Still, European consumers and businesses are not rushing to install air conditioning. The reason cited by French consumers (in a survey) were "energy costs and environmental impacts."

As the price of energy increases in the EU, people are struggling to justify the costs, especially with a 20% tax on air conditioning in France. City dwellers also realize that air conditioners heat the outside as much as they cool the inside, leading to urban heat islands. No one wants to be accused of putting their neighbors in discomfort.

In the US, air conditioning has influenced where people moved since the 1950s.

In 1950, the Sunbelt region (Florida, Texas, Arizona, Southern California, Georgia and New Mexico) started to experience tremendous growth due to the air conditioner. From 1950 to the year 2000, Texas experienced a 170% population increase, the largest for all of the states in the Sunbelt region.

With the large populations in southern states now experiencing intense heat, we're seeing utilities ask consumers to adjust their thermostats to save energy. In Texas, the utility is forces the choice in some cases, adjusting it themselves via smart thermostats.

Over the past few months, I've had numerous conversations with retail and CPG customers trying to surface environmental information like this to consumers. The goal is to help consumers make more informed choices about their purchases with sustainability as a factor, something that we don't appear to be doing in the US today.

💰Incentives

Change is hard and making the sustainable choice requires an educational lift. Consumers understand broadly that adjusting a thermostat uses more energy, but it might not be until a brownout that they understand their contribution to the issue.

If people aren't changing behaviors and making sustainable choices, incentives can help.

Late last Friday, the Inflation Reduction Act (IRA) was passed by Congress and headed to Biden's desk for signature. In part, this bill contains several consumer-facing benefits and incentives, including:

$9 billion in consumer home energy rebate programs, focused on low-income consumers, to electrify home appliances and for energy efficient retrofits.

10 years of consumer tax credits to make homes energy efficient and run on clean energy, making heat pumps, rooftop solar, electric HVAC and water heaters more affordable.

$4,000 consumer tax credit for lower/middle income individuals to buy used-clean vehicles, and up to $7,500 tax credit to buy new clean vehicles.

$1 billion grant program to make affordable housing more energy efficient

Incentives help ease the choice toward sustainability, and some provisions for consumer education are in sections. Personally, I am exploring solar right now and this is factoring into the decision. Still, the bill has been criticized for not doing enough to drive substantial change.

In some places, it even appears to go backward. Per a Forbes article:

It would resurrect canceled offshore oil and gas lease sales and lock in new oil and gas sales onshore — which would be tied to future federal auctions for solar and wind rights.

However, Dr. Leah Stokes has a more optimistic take:

This should help the argument to electrify everything. Individuals electrify everything, and you incentivize green energy at the grid level. Parts of this are in the bill, too:

Tax credits for clean sources of electricity and energy storage and roughly $30 billion in targeted grant and loan programs for states and electric utilities to accelerate the transition to clean electricity

Overall, the bill incentivizes infrastructure changes and lowers the entry level for consumers, but how far individual changes will go remains to be seen. As individuals, choice as part of a bigger cultural norm is one driver, but incentives that make it more affordable can also initiate change.

In other words, individuals might be able to afford to make sustainable choices, but likely need help.

🏙️Companies, sustainability, and ESG

Companies are struggling to determine whether to focus on sustainability, ESG, or both. As always, the two get conflated, but both can represent different ways to focus on what really matters.

When I talk with companies, I see a range of activities from table stakes sustainability efforts into more ESG-focused risks and opportunities, but it varies. If this journey was linear (it's not), it might look like this:

🍃Sustainability is Table Stakes

Like individuals, companies can choose to be more sustainable. The impact can range from philanthropic programs to becoming a certified B-Corp.

Companies are under enormous pressure from stakeholders to address sustainability issues. Sometimes, these programs will be concessionary in the short-term (which is how the market will measure them) but could have long-term benefits, such as:

Talent retention

New customer acquisition

Lower costs of capital

Brand reputation

Much of this happens at the operational level of the business. I call it 'table stakes' because I see so many companies focusing on it that it will be hard to compete if you don't.

🌎🌈⚖️ESG: Materiality and Opportunities

Materiality is where a lot of the confusion comes in. Identifying ESG material issues helps a company mitigate risk. As we see each week, this is a wildly complex proposition with numerous factors to consider for each material issue.

For example, do you divest from a supplier who isn't cleaning up their act only to bring a new, unknown supplier in? Do you move operations from the global south because their emissions are high, or do you engage and try to support their clean energy transition?

ESG represents a focus on the business through a new lens, but not one that is foreign or against the business. ESG issues are core business issues.

Slowing down to consider and address ESG issues can help deliver sustainable results, reduce risk, and create opportunities.

Let's say you are a home construction company using wood to build frames. If your supplier isn't replenishing forests, how long will it be before they run out of lumber? If you are a supplier, there is a massive opportunity to change as the green materials market is set to grow at a CAGR of 10.16% in the coming years.

Both sustainability and ESG can be incentivized through regulation and government action. There are currently 3 big proposals for reporting from the SEC, the EU Commissions (CSRD), and the ISSB. Like consumers, there can also be incentives, like other parts of the IRA, which are largely focused on decarbonizing the economy through greener manufacturing and energy systems.

🌎Countries and Degrowth

In a capitalist society where never-ending growth is expected, slowness can mean fleeing investors, losing talent, and higher costs of capital. Our current economic systems aren't set up for thoughtful consideration of what matters.

Here's what our current economic system is set up for:

Headline: Disney+ Soars, Netflix Sinks: Here’s How Many Subscribers 10 Key Streamers Have Now (yahoo.com)

We're pitting streaming services with different content against each other around endless growth. In reality, these customers likely have several services. I know I do!

When you have a system built around growth, concepts like ESG are described as a 'win-win.' ESG investing gets described as chasing 'alpha.' People are trying to convince you that sustainable efforts can provide growth. Sure, there will be cases where 'win-win' on ESG issues do happen, but not always. Sometimes addressing ESG issues have a high cost, especially in the short term. For ESG investing, 'alpha' isn't the goal, but long-term, stable returns might be. For Sustainable investing, the goal is less about growth and more about what matters, but it sits within a market system around growth.

So, what would it look like if our global economy is structured to allow for the things that matter and not just never-ending growth?

📉One Option - Degrowth

During COVID, when we saw economies being forced to scale back, an idea from the 1970s came to the forefront - degrowth. WEF defines degrowth as:

Degrowth broadly means shrinking rather than growing economies, so we use less of the world’s energy and resources and put wellbeing ahead of profit.

Unlike what we experienced with COVID, however, degrowth is an intentional slowing of economic growth to focus on the things that matter. It also is an economy based on what you need, not what you want. After all, is it realistic to expect every sector of every country's economy to grow constantly?

The arguments made in this sesquimateriality paper would seem to indicate otherwise. Even a diversified portfolio focused on growth can't necessarily distribute externalities out enough. Someone somewhere has pain when growth is the goal.

For example, the IRA is focused on switching dirty energy to clean energy and driving efficiency. This might be what I consider 'green growth.' Jobs will be created, appliances will be purchased, and solar panels/wind turbines will be installed. Still, every energy-efficient thing incentivized in the IRA is built from resources with little consideration to its manufacture other than its energy efficiency. Those resources are externalities.

NOTE: I am not saying the IRA is bad. I'm saying it does not promote degrowth.

At the system level, degrowth intentionally slows down the economic system around what matters. With worldwide concerns about climate change and resource scarcity, governments are considering what is needed to create new sustainable economies. Degrowth could afford us a chance to do both responsibly by forcing us to operate within the boundaries of our planet. ESG practitioners are often cognizant of this, but boundaries aren't always considered due to the need for growth.

This systemic change would require massive collaboration across governments worldwide, markets, companies, and the consumer. It might also spin out of a massive social movement, as Jason Hickel, author of Less is More, talks about in this Upstream podcast (which is a great degrowth primer).

It wouldn't be easy, but it is starting to become less controversial than you might think.

The IPCC's biodiversity counterpart IPBES last month included degrowth among a number of alternative economic models with insights that could help to arrest environmental degradation.

and it wasn't questioned!

Degrowth isn't only about the environment either. It's about distributing equity globally to raise the standard of living for all by fixing the socio-economic perspective that GDP lacks. Here's how Orla Kelly, Assistant Prof in Social Policy, put it in The Irish Times.

In addition, advocates of degrowth argue that the reduction in environmental stress related to slower growth in higher-income nations makes space in the global carbon budget for those in low-income countries to raise their standard of living...the degrowth perspective couples socio-ecological policy intervention with an emphasis on cultural transformation, such as less intensive consumption and grassroots community initiatives.

I think we're largely in uncharted territory here and people can feel it, even Jamie Dimon, who warns that "something worse is coming."

Is it something worse or just something wildly different?

If you're interested to learn more about degrowth, check out these resources.

Life in a 'degrowth' economy, and why you might actually enjoy it — theconversation.com

This throwback article (2014) outlines degrowth well for everyone. It's about "producing and consuming less."

For the academic/researcher, there is this summary paper. From the abstract:

Here we review studies of economic stability in the absence of growth and of societies that have managed well without growth. We reflect on forms of technology and democracy compatible with degrowth and discuss plausible openings for a degrowth transition. This dynamic and productive research agenda asks inconvenient questions that sustainability sciences can no longer afford to ignore.

Degrowth – The Myth of Ever Expanding Growth Has Met Its Limits. Is Degrowth the Answer? - The Sustainability Story — open.spotify.com

Timothee Parrique, Ph.D. in economics and researcher at Lund University, talks about degrowth, what it is, what it isn’t, and how our obsession with GDP and growth are flawed measures of progress.

Tweet of the Week

Here's Climate Dad with a TLDR version on degrowth: